Configure taxes

This chapter covers the settings of the nopCommerce tax tools.

Note

This chapter includes nopCommerce in-built tax instruments, not third-party tax services.

nopCommerce supports external services as well, but they require plugins from the marketplace to be installed. The installation process of such modules is described in the Plugins chapter.

EU VAT configuration guide

To set up nopCommerce VAT support for shops in the EU, go to Configuration → Settings → Tax settings.

In the Common panel:

- Set Tax based on to Shipping address.

In the VAT panel:

- Select EU VAT enabled. This will ensure that tax is charged only for shipments within the EU.

- Select the Country your shop is in.

- If applicable, select Allow VAT exemption. This will ensure that your VAT registered customers who are shipping within the EU but outside the country in which the store is located will not be charged VAT.

- Select the Assume VAT always valid checkbox to skip VAT validation. Entered VAT numbers will always be valid. It will be a client's responsibility to provide the correct VAT number.

- If you checked Allow VAT exemption, then you might want to select the "Use web service" and "Notify admin when a new VAT number is submitted" checkboxes too.

Click the Save button.

Go to Configuration → Countries. Make sure that all the countries in the scope of the VAT have Subject to VAT set to true.

Note

Jersey, Guernsey, and the other Channel Islands are neither a part of the UK nor within the scope of the VAT. If you sell to those places, you might need to change that.

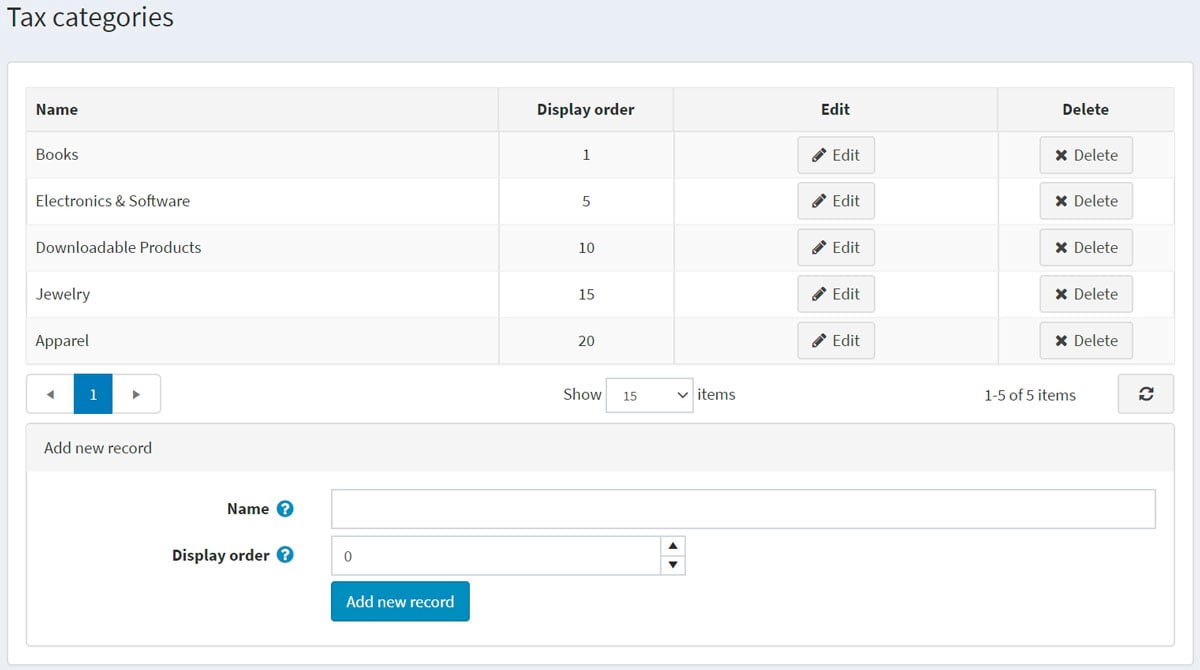

Go to Configuration → Tax categories.

Set up a tax category for each VAT rate in your country. For example, "Standard Rate," "Zero rate," "Discounted rate." Delete default classes that are already there but not applicable.

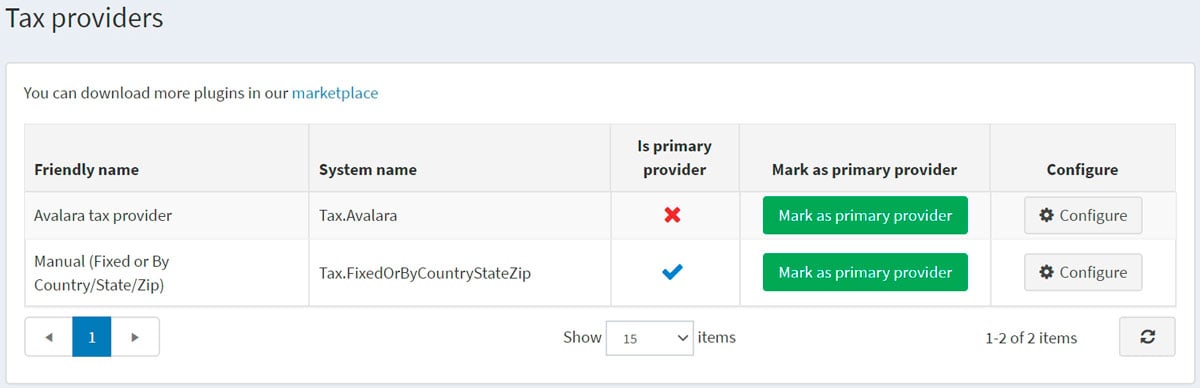

Go to Configuration → Tax providers. Select the Manual (fixed or by country/state/zip) as the default one using the Mark as primary provider button.

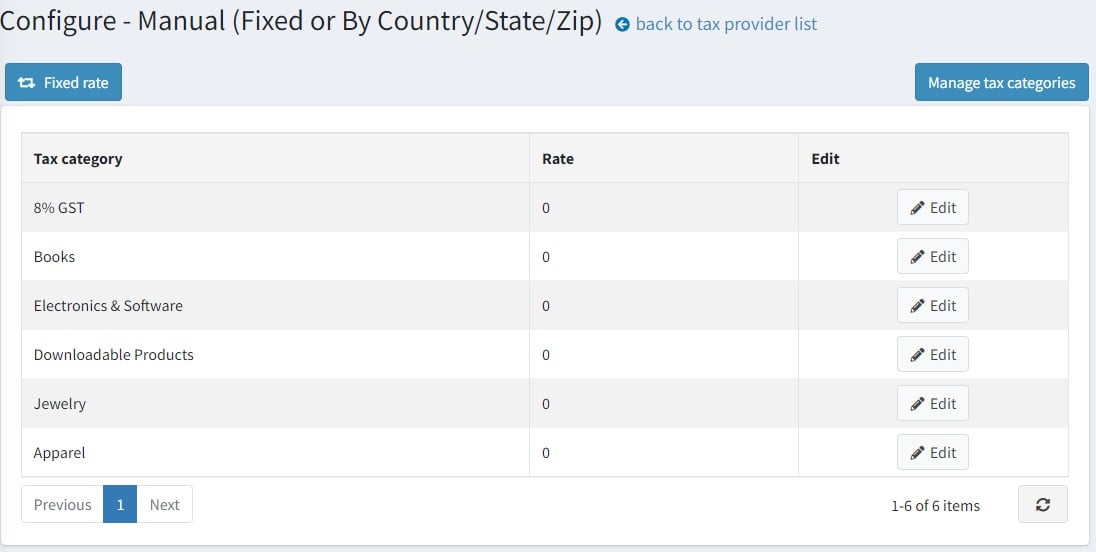

Click Configure in the Manual (fixed or by country/state/zip) provider line to edit tax rates. At the top of the page, you will see the button. Click on the button to switch to the Fixed rate mode.

On this page, you can see your VAT rate categories. Click Edit beside each category and enter the percentage rates. Then click the Update button.

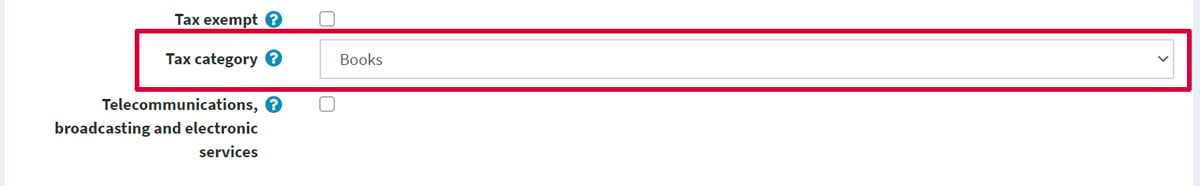

Make sure that all products have a tax category assigned to them on their product pages.